3/3 steps

Looking for Japanese Knotweed Removal?

Remove Japanese Knotweed from your property permanently and avoid facing the cost of Knotweed damage by investing in professional Knotweed removal services.

Japanese Knotweed Removal

Japanese Knotweed is one of the hardest invasive plants to fully remove from your property. It’s fast growing ability means it can fully take control of your land if not treated early, leading to potential Japanese Knotweed damage to your property, a decrease in property value or costly legal battles if you have allowed Knotweed to spread to a neighbouring property. Its complicated network of roots (rhizomes) make it especially difficult to remove, as most homeowners may not know how to tackle the problem of Japanese knotweed removal properly, simply pulling up the plant when they see it, not accounting for the roots that will lead to regrowth.

Japanese Knotweed’s robust plant structure means has the ability to grow in most environments, making Japanese Knotweed removal difficult. With it’s low temperature tolerance it can quickly exploit gaps in structures such as concrete and brick. By using an experienced Japanese Knotweed removal specialist, with extensive knowledge of how to get rid of knotweed, you can control the problem.

What Does the Japanese Knotweed Removal Process Look Like?

1. Request Survey

It's important to have an expert visit your property to carry out a comprehensive site survey. Please see our surveys page for further information. Alternatively give us a call on 0800 3891911 and one of our Japanese knotweed removal experts will be able to guide you through the process.

2. Survey & Quotation

One of our Japanese knotweed surveyors will visit your property, assess the grounds and talk you through their findings. Using the information gathered, we will be able to provide you with a detailed written quotation and recommendation of the best treatment plan within 24 hours for herbicide treatment. For excavation quotations, timing will depend on the scale of the works.

3. Treatment

Once agreed, we will begin Japanese knotweed works. Our 5 year treatment plans can be implemented at any point throughout the year, enabling you to move on with your life without delay! Excavation works can be carried out within 1-2 weeks making the process even quicker where required.

4. Monitor

Once the herbicide treatment period or excavation works have reached completion, your property will enter a monitoring period. During this time, our team will regularly visit your property to ensure no regrowth occurs.

5. Guarantee

As soon as Japanese knotweed work begins, we supply our 10-Year Insurance Backed Guarantee documentation. This includes a 10-year company guarantee certificate and also a 10-year insurance policy to back our guarantee. This guarantee will cover your property against the regrowth after remediation. This means that in the highly unlikely event you encounter regrowth, simply need t contact our team. The insurance element will only come into effect should the contractor cease trading.

Looking for professional Japanese Knotweed treatment?

We are an expert Japanese Knotweed removal company servicing a widespread area within the UK. Following one of our in-depth surveys, we will select the best removal plan depending on the extent of the infestation. Our specialist team will often use a variety of approaches for eliminating the weed, to control the spread on your property.

Types of Japanese Knotweed Removal Available

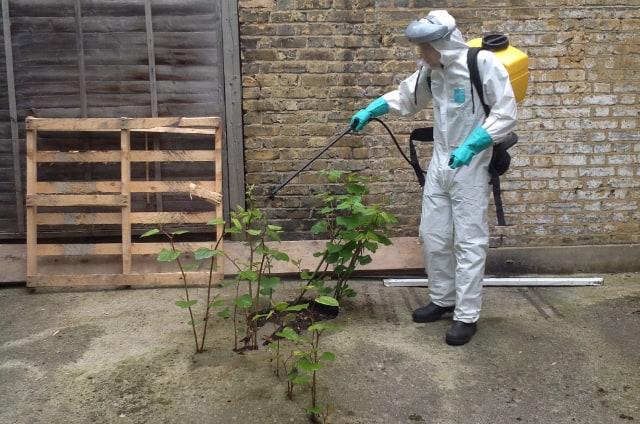

Foliar Spray

Timescale: 3-5 Growing Seasons

Using a knapsack sprayer, herbicides are applied to the top and underside of the plants leaves surface. This happens twice a year; once during the early part of the growing season (April – June) and then again during late summer/autumn (July – September).

How it works:

- Herbicides are applied to the top and underside of the leaf, this is absorbed and carried into the plant.

- The herbicide within the plant takes effect, and over a period of time kills the plant at its base. Time varies depending on different factors, taking effect from as little as 4 days, up to a few months.

Repeat applications of herbicide cause the plant to become stunted and reduce its capacity to photosynthesise and therefore regenerate. You can expect over the course of 3 years the plant will completely die back.

Stem Injection

Timescale: 3-5 Growing Seasons

TP knotweed’s stem injection system offers excellent results when you are looking to remove smaller concentrations of knotweed around your home or garden.

This process involves injecting a specified dose of undiluted herbicide directly in to the stems of the plant, between the first and third ‘node’ of the stems. This process has the benefit of reducing the possibility of damaging non-target plants, however this method is only suitable for smaller infestations and can take longer to administer compared with a foliar spray.

Benefits of stem injections include:

Cost-effective solution for getting rid of knotweed

- Treatment can go ahead regardless of the weather

- Environmentally friendly with no negative effects on nearby plants or wildlife

- If a Tree Preservation Order is in place, stem injection is safe to use

- Ideal for use near water or on sensitive site

You should consider that herbicide treatments can present problems when you have plans to landscape the garden, extend the house or re-turf the lawn. Although effective, you are unable to dig or disturb the soil as it can spread the plants further and invalidate your guarantee.

Complete excavation & off-site disposal

Duration: On-site work followed by 2 years monitoring

This service involves the physical excavation of contaminated soils, ideal where the discovery of Japanese knotweed has halted property developments or extension work.

In this scenario, there is no time to carry out a 5 year herbicide treatment programme, especially if you have plans to excavate ‘Controlled Waste’ soils and develop within the affected areas. In these cases, immediate knotweed treatment via physical excavation and licensed disposal of the Controlled Waste is the best option.

Experienced excavators chase the Rhizome network using CAD site plans rather than excavating indiscriminately. This minimises costly unaffected soils from being removed from site.

Following successful excavation and disposal, you are provided with a 10 Year Insurance Backed Guarantee, from a leading insurer, which becomes valid once the excavation works and monitoring period have been completed on site.

Development work can commence as normal once the site is finished being remediated. Typically an excavation can take 1-2 weeks to complete, and are monitored on a bi-annual basis for 2 years following completion to ensure no re-growth occurs. For our private households and residential gardens, our ‘rapid excavation service’ can excavate Japanese knotweed from your garden within days.

Benefits of excavation include:

- knotweed can be completely eradicated from a site very quickly

- Development and landscaping works can commence following remediation with no restrictions

- 10 year Insurance Backed Guarantees available

- Mortgage compliant treatment method

- Can take place at any time of year

You should consider that the cost of excavation can be higher than other methods. Excavation must be carried out by a recognised specialist to ensure legislation is complied with and that soil is disposed of by a licensed company.

Japanese Knotweed damage

Japanese Knotweed shoots can grow up to 3 metres high through your plumbing, building foundations, and driveways. It outcompetes native vegetation and can also lead to erosion, causing long term flooding issues.

Its ability to exploit existing weaknesses in properties as well as underground systems, walls and building foundations can result in extensive damage and can mean repair work, and Japanese Knotweed removal fees can range into the thousands. With its advanced root network, the rhizomes grow through any structure.

Your mortgage and house price can also suffer. Legally, Japanese Knotweed must be disclosed to buyers and banks. Many lenders have been reluctant to approve mortgages on properties with a history of Knotweed without a solid Japanese knotweed treatment plan or 10 Year Insurance Backed Guarantee.

The Wildlife and Countryside Act prohibits planting Japanese Knotweed or disposing of cuttings in an irresponsible manner that might let it grow back. Japanese Knotweed can grow back, from cuttings as small as 2mm. This makes home Japanese Knotweed removal almost impossible without risk of costly fines and criminal action.

How does Japanese Knotweed spread?

Not only can it damage and destroy hard surfaces, such as tarmac, concrete and brick walls, the plant grows so quickly and spreads so easily, it can deprive native plants of nutrients and sunlight, causing them to die. Having evolved on the harsh conditions of the sides of volcanoes in Japan, its growth rate is legendary.

In summer months the plant can grow up to 10cm a day, reaching a height of around 2 metres.

Digging and cutting Japanese Knotweed is not advised under any circumstances, as this can contribute to the spread of the weed. If you have Japanese Knotweed on your property and you allow it to spread to a neighbours land, you can face fines of up to £2,500.

Japanese Knotweed is the UK’s most aggressive invasive weed. Left untreated, it will spread and spread. It is a criminal offence to allow the weed to spread from your land to a neighbouring property.