Selling a house may be challenging if Japanese knotweed is positively identified on or near your property. This is a result of the challenges posed by Japanese knotweed law, which has caused mortgage lenders to approach residences afflicted by this alien infestation with caution. Although it is feasible to obtain a mortgage on a house that has Japanese knotweed present, you may need to jump through additional hoops to convince the bank that their money is secure with you.

What is Japanese knotweed and why the concern?

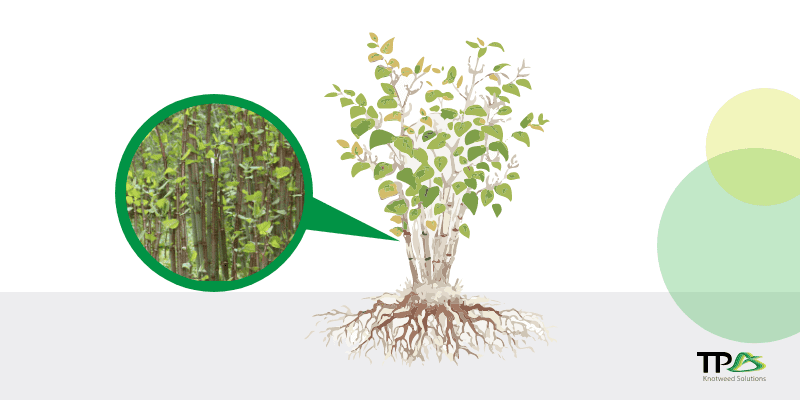

Many of us have heard terrifying tales about Japanese knotweed infestations and how they may affect a home sale or mortgage application. This aggressive weed native to Japan has a resilient and destructive nature and is known to cause threatening damage to the environment and nearby infrastructure. In the spring and summer, it grows exceptionally fast, often by several centimetres each day.

This invasive plant has extraordinarily strong roots that may stretch as far as 7 metres beneath the surface, but in most cases 1.5 – 2 metres. For these reasons, Japanese knotweed has caused extensive damage to the property market as well as the UK economy at large.

Does knotweed affect mortgage options?

Most mortgage lenders would initially decline to lend if Japanese knotweed has been found in the property’s garden or other neighbouring gardens. In that instance, the value of the property might be substantially impacted in the property valuation report.

Due to the disruption and damage that Japanese knotweed can do over time, getting a mortgage might be challenging. This invasive plant can penetrate asphalt and paving, harm and crack drainage systems, take advantage of flaws in concrete surfaces, destroy boundary brick walls, and have a big impact on the landscaping that can be done in a garden.

Mortgage Lender Concerns

It is expected that Japanese knotweed’s damaging nature is what makes mortgage lenders cautious when offering loans. Even in cases where there hasn’t been any damage, its existence inside a property’s boundaries might lower the value because there is still a chance for further harm. This is especially true for buyers who intend to renovate because it can make building considerably more challenging and expensive.

Japanese knotweed was originally introduced to prevent railway embankments from eroding or collapsing but has since spread further than intended. This means there is a high risk that residences built next to or in the proximity of railroad lines have been affected.

The good news is that harm to the structural integrity of residential properties is extremely uncommon, especially when compared to other invasive plant species, according to several scientific studies. Since then, RICS ( Royal Institution of Chartered Surveyors) has released updated advice on Japanese knotweed, which went into effect in March 2022.

As a result, lenders are feeling more comfortable with offering loans on homes near areas where Japanese knotweed is a concern. However, each application for this type of loan is still evaluated individually, depending on the extent of any damage or the likelihood of further devastation.

Mortgage Lenders’ Criteria

The “7-metre rule,” which advised that Japanese knotweed located within 7 metres of the property line was not acceptable, was, until recently, heavily relied upon by mortgage lenders when determining the level of risk involved with financing.

However, this guideline has changed, and opinions may vary depending on the lender in light of the recent RICS guidance that stated that harm to “strong buildings with large foundations” is improbable. Surveyors are now required to examine the risks of Japanese knotweed within the property borders using their own discretion.

Although it would take some time for this new way of thinking to spread to all lenders, the criteria are likely to be more relaxed in the near future. The old risk matrix, which divided the presence of Japanese knotweed into 4 categories, is still used by certain lenders as the foundation for their lending decisions.

This means that if Japanese knotweed is present at the property you want to buy, you might still need to meet the following requirements:

- Make a greater down payment/deposit.

- Enrol in a treatment program that is supported by PCA or INNSA and may need years of upfront payment.

- Request that a PCA (Property Care Association) or INNSA member remove knotweed (Invasive Non-Native Specialists Association)

- Of course, there are also standard requirements for mortgage loans that differ from lender to lender, including affordability, creditworthiness, age restrictions, and property types.

How to get a mortgage with Japanese knotweed present

Step 1:

A RICS homebuyer survey or building survey may be ordered by some buyers. Ideally, your RICS surveyor would search the garden for signs of the invasive species Japanese knotweed.

Step 2:

If Japanese knotweed has been identified, the surveyor will advise you to hire a qualified and accredited company, such as TP knotweed Solutions, to conduct a Japanese knotweed Survey to determine the severity of the problems and create a specialised report.

Step 3:

It’s vital to know that most lenders will change their minds and approve a Japanese knotweed mortgage if a 10-year insurance-backed guarantee and an approved 5-year invasive plant removal strategy are in place. This needs to be done by a qualified expert in Japanese knotweed who is also a member of the Property Care Association.

Take the first step with a Japanese knotweed Survey

Mortgage lenders have mixed approaches to how they handle cases of Japanese knotweed, making it crucial to find out your mortgage lenders’ policies on Japanese knotweed.

With a trustworthy treatment plan in place and a 10-year insurance-backed guarantee, there is no valid reason why the presence of Japanese knotweed on the property should hinder you from buying or selling a property.

Get in touch with our specialist knotweed surveyors to discuss your Japanese knotweed survey options, and make the sale or purchase of your property possible.